Press Release

Offering Document under the Listed Issuer Financing Exemption

The securities offered under this offering document under the Listed Issuer Financing Exemption (the “Offering Document”) have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons or persons in the United States except pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. This Offering Document does not constitute an offer to sell or a solicitation of an offer to buy any of the securities offered hereby within the United States or to, or for the benefit of, U.S. persons or persons in the United States. “United States” and “U.S. person” have the meanings ascribed to them in Regulation S under the U.S. Securities Act.

Click here for downloadable version

Offering Document under the Listed Issuer Financing Exemption

June 12, 2023

PharmAla Biotech Holdings Inc.

(the “Issuer”)

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this document. Any representation to the contrary is an offence. This offering may not be suitable for you and you should only invest in it if you are willing to risk the loss of your entire investment. In making this investment decision, you should seek the advice of a registered dealer. The Issuer is conducting a listed issuer financing under section 5A.2 of National Instrument 45-106 Prospectus Exemptions. In connection with this offering, the Issuer represents the following is true:

• The Issuer has active operations and its principal asset is not cash, cash equivalents or its exchange listing.

• The Issuer has filed all periodic and timely disclosure documents that it is required to have filed.

• The total dollar amount of this offering, in combination with the dollar amount of all other offerings made under the listed issuer financing exemption in the 12 months immediately before the date of this offering document, will not exceed $5,000,000.

• The Issuer will not close this offering unless the Issuer reasonably believes it has raised sufficient funds to meet its business objectives and liquidity requirements for a period of 12 months following the distribution.

• The Issuer will not allocate the available funds from this offering to an acquisition that is a significant acquisition or restructuring transaction under securities law or to any other transaction for which the Issuer seeks security holder approval.

PART 1 SUMMARY OF OFFERING

What are we offering?

Offering:

Non-brokered private placement of units of the Issuer (“Units”), with each Unit being comprised of one common share of the Issuer (each, a “Common Share”) and one-half common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant shall be exercisable to acquire an additional Common Share (each, a “Warrant Share”) at an exercise price of C$0.45 per Common Share for a period of 24 months following the Closing Date (as defined herein).

In the event that, during the period following 24 months from the Closing Date (as defined herein), the volume-weighted average trading price of the

Common Shares exceeds C$0.675 per Common Share for any period of 20 consecutive trading days, the Issuer may, at its option, following such 20-day period, accelerate the expiry date of the Warrants by issuing a press release (a “Warrant Acceleration Press Release”), and, in such case, the expiry date of the Warrants shall be deemed to be 5:00 p.m. (Toronto time) on the 30 th day following the date of issuance of the Warrant Acceleration Press Release.

Offering price:

C$0.30 per Unit

Offering amount:

A minimum of 3,333,333 Units (the “Minimum Offering”) and a maximum of 16,666,666 Units (the “Maximum Offering”), for minimum gross proceeds

of C$1,000,000 and maximum gross proceeds of C$5,000,000 (the “Offering”).

Closing date:

It is expected that the Offering may close in one or more tranches with the final closing to occur no later than July 27, 2023 (each a “Closing Date”).

Exchanges:

The Common Shares are listed for trading on the Canadian Securities Exchange (the “CSE”) under the trading symbol “MDMA” and on the Over-The-

Counter market (“OTC”) under the trading symbol “PMBHF”. The Issuer will make all requisite filings and notifications to the CSE and the OTC.

Last closing prices:

The last closing price of the Common Shares on June 12, 2023 was C$0.33 on the CSE and US$0.227 on June 9, 2023 on the OTC.

Cautionary Note Regarding Forward-Looking Statements

This Offering Document contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws (collectively, “forward-looking statements”). All information, other than statements of historical facts, included in this offering document that address activities, events or developments that the Issuer expects or anticipates will or may occur in the future, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Issuer's businesses, operations, plans and other such matters are forward-looking statements. Forward-looking statements are often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” or similar expressions and includes, among others, information regarding the size and terms of the Offering; the Issuer’s business objectives and milestones and the anticipated timing of execution; expansion and distribution of the Issuer’s products, including MDMA (as defined herein) capsules; completion of the Offering on the terms provided herein; the intended use of proceeds from the Offering; expectations regarding future financial results of the Issuer and the Issuer’s belief that its financial statements for subsequent periods will contain a going concern note; the Issuer’s believes in respect to revenue derived from manufacturing of generic molecules and its intellectual property; the Issuer’s belief that there is a market for clinical-grade MDMA, as well as a commercial market for the Issuer’s products in Australia; the execution of definitive exclusive supply agreement with Revive Therapeutics Ltd.; the advertisement and registration of PharmAla Trademark (as defined herein) and LaNeo Trademark (as defined herein); the results of the PCT (as defined herein) application; the receipt of a license for the Issuer’s Intellectual Property (as defined herein) by Cortexa (as defined herein) and contemplated benefits herein; the benefits of the Vitura Joint Venture (as defined herein); the supply of MDMA free of charge under the SAP (as defined herein); and the sufficiency of cash and working capital for future operating activities.

In making the forward-looking statements in this offering document, the Issuer has applied several material assumptions, including without limitation: the Issuer obtaining requisite regulatory approvals and the satisfaction of other conditions to the consummation of the Offering on the proposed terms herein; the Issuer’s ability to comply with all applicable regulations and laws, including environmental, health and safety laws; the Issuer’s

ability to meet the listing requirements of the CSE; the Issuer having sufficient working capital for future operating activities; the ability of the Issuer to achieve its business objectives and milestones and the anticipated timing of execution; the Issuer’s ability to find a market for its products, including clinical grade MDMA; the Issuer’s ability to generate revenue from manufacturing of generic molecules and its intellectual property; the

Issuer executing a definitive exclusive supply agreement with Revive Therapeutics Ltd.; the Issuer’s ability to register PharmAla Trademark and LaNeo Trademark; Cortexa receiving license for the Issuer’s Intellectual Property; the Issuer’s ability to realize benefits from the Vitura Joint Venture; the Issuer’s ability to use novel compositions of MDMA and analogs thereof from the PCT to alleviate the known side effects of MDMA while retaining its efficacy; the Issuer’s ability to continue as a going concern; the Issuer’s ability to achieve profitability in the 2023 fiscal year; the Issuer’s ability to obtain additional financing for continued operations on terms acceptable to the Issuer; the Issuer’s ability to satisfy the terms and payment of cash commission and finder warrants to eligible finders; the Issuer’s ability to supply MDMA free of charge under the SAP (as defined herein); and the Issuer’s ability to use the proceeds from the Offering for the business objectives outlined herein.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect expectations of the Issuer’s management, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Issuer believes that the expectations reflected in such forward-looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by the Issuer. Among the key risk factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: changes in general economic, business and political conditions, including changes in the financial markets; the inability of the Issuer

to complete the Offering on the terms contemplated herein; delays or the inability of the Issuer to obtain necessary permits, consents or authorizations required; changes in laws, regulations and policies affecting the Issuer’s operations; currency fluctuations; environmental issues and liabilities; the potential impact of the announcement or consummation of the Offering on relationship, including with regulatory bodies, employees, suppliers, customers and competitors; the Issuer’s inability to continue to meet the listing requirements of the CSE; the inability of the Issuer to obtain additional financing for continued operations on terms acceptable to the Issuer; the lack of control over the Issuer’s investees; risks relating to investing in the Common Shares; risks relating to the use of proceeds from the Offering; volatility in the market price of the Issuer’s Common Shares; dilution of shareholders’ holdings; negative operating cash flow; the negative effects of interest rate and exchange rate changes; the potential impact of health crises and market instability due to the COVID-19 pandemic; risks relating to the Issuer’s reliance on key employees; limitations in the liquidity of the Common Shares; litigation risks; risks related to the Issuer’s status as a “foreign private issuer” under U.S. securities laws, including the loss of status thereof; risks with the integration of new businesses and acquisitions; the Issuer’s inability to expand into new business areas and geographic markets; management of growth; the risk of defaulting on existing debt; the Issuer’s inability to generate revenue from manufacturing of generic molecules and its intellectual property; the Issuer’s inability to execute a definitive exclusive supply agreement with Revive Therapeutics Ltd.; the Issuer’s inability to register PharmAla Trademark and LaNeo Trademark; the Issuer’s inability to realize benefits from the Vitura Joint Venture; the Issuer’s inability to use novel compositions of MDMA and analogs thereof from the PCT to alleviate the known side effects of MDMA while retaining its efficacy; the Issuer’s inability to continue as a going concern; the lack of control over the Issuer’s investees; the participation of insiders in the Offering; litigation risks; the Issuer’s inability to supply MDMA free of charge under the SAP; and the Issuer’s inability to achieve profitability in 2023.

These factors should be considered carefully, and readers are cautioned not to place undue reliance on suchforward-looking statements.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Issuer has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Issuer does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Issuer’s filings with Canadian securities regulators, including its most recent MD&A, which are available at

www.sedar.com. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in forward-looking statements.

PART 2 SUMMARY DESCRIPTION OF BUSINESS

What is our business?

The Issuer is a Canadian biotechnology company dedicated to the manufacturing and sale of 3,4 –Methylenedioxymethamphetamine (“MDMA”) and substituted methylenedioxy-phenethylamines (“MDXX”) class molecules in service to the burgeoning clinical research community. The Issuer has three primary business lines: (i) the manufacturing of MDMA and MDXX class molecules for sale to clinical researchers in both the commercial and academic spheres, (ii) the research and development of novel MDXX class compounds which offer benefits above and beyond currently known substances, and (iii) the development of novel delivery mechanisms for MDMA and MDXX class compounds.

The Issuer believes that there is a significant market in Canada and other relevant markets for clinical-grade MDMA for scientific research, the supply of which is constrained by manufacturing bottlenecks and regulatory restrictions. Subsequent to the regulatory change announced by the Australian Therapeutic Goods Agency (“TGA”), there is also now a commercial market for the Issuer’s products in that market.

While the Issuer anticipates that business line (i), namely the manufacturing of clinical grade MDMA for sale to researchers, is likely to generate revenue in 2023, the Issuer also believes that manufacturing generic molecules is unlikely to yield stable long-term revenue as the supply of these molecules increases over time. As such, the Issuer believes that significantly more long-term value can be derived from activity which generates significant intellectual property, such as the Issuer’s business lines (ii) and (iii). While these business lines are likely to generate value in the long-term, they are unlikely to generate short-term revenue as this revenue is dependent on the Issuer achieving its regulatory milestones.

Recent developments

The following are material recent developments of the Issuer since the filing of the Issuer’s audited financial statements and management’s discussion and analysis for the year ended August 31, 2022 and for the period from December 23, 2020 (date of the Issuer’s incorporation) to August 31, 2021.

The Issuer Named Exclusive MDMA Supply Partner to Awakn LS Europe Holdings Limited

On October 11, 2022, the Issuer received a purchase order from Awakn LS Europe Holdings Limited for 300 grams of the Issuer’s good laboratory practice-compliant (“GLP”) MDMA, for a total consideration of US$40,000, excluding transportation costs.

On February 28, 2023, the Issuer and Awakn entered into an exclusive supply agreement for a period of three years, until February 28, 2026, for the supply of GLP and good manufacturing practice-compliant (“GMP”) MDMA by the Issuer (“Awakn Agreement”). Pursuant to the terms of the Awakn Agreement, the price per gram of MDMA is: (i) US$216 for GLP MDMA and US$5,000 for GMP MDMA for purchase orders under the volume below 25 grams per purchase order, (ii) US$3,000 for GMP MDMA for purchase orders over the total volume of 50 gram per purchase order, and (iii) US$2,000 from GMP MDMA for purchase orders over the total volume of 100 gram per purchase order.

Export Permit for 300 grams of the Issuer’s MDMA

On January 12, 2023, the Issuer’s manufacturing partner was granted an export permit by Health Canada until February 28, 2023 for an export of 300 grams of the Issuer’s MDMA to the United Kingdom.

TGA Announces Regulatory Changes to MDMA and Psilocybin as of July 1, 2023

On February 3, 2023, the TGA announced that both MDMA and psilocybin would be allowed for use as medicine, so long as they are prescribed by the authorized prescribers in Australia. This development has created a new market for the Issuer’s products.

Letter of Intent for the Supply of MDMA to Revive Therapeutics

On February 5, 2023, the Issuer and Revive Therapeutics Ltd. entered into a non-binding letter agreement for the exclusive supply of the Issuer’s GLP MDMA and GMP MDMA (“Revive LOI”) to Revive Therapeutics Ltd.

Emyria Ltd. Purchase Order

On February 9, 2023, the Issuer received a purchase order from Emyria Ltd. for the Issuer’s 24.8 grams of GMP MDMA for an aggregate consideration of US$120,000, excluding transportation costs (the “Emyria Purchase Order”). The Issuer placed the Emyria Purchase Order for processing on February 14, 2023. Emyria Ltd. is an Australia-based clinical stage biotech company developing treatments for mental health and neurological conditions.

Trademark Application for “LaNeo” and “PharmAla” in Australia

On February 8, 2023, the Issuer filed a trademark application with IP Australia, an Australian Government agency responsible for administering intellectual property law in Australia (“IP Australia”) for “LaNeo” brand name (“LaNeo Trademark”) and “PharmAla” brand name (“PharmAla Trademark”). PharmAla Trademark and LaNeo Trademark have been accepted by IP Australia on March 29, 2023 and March 30, 2023, respectively,

but have not been registered yet.

Patent Application Published for the Issuer’s MDMA Analogs

On February 23, 2023, the Issuer announced the publication of a key Patent Cooperation Treaty (“PCT”) application containing six Novel Chemical Entities (“NCEs”). The application claims priority to and benefit of a United States provisional patent application filed on August 20, 2021. The PCT application disclosed novel compositions of MDMA and analogs thereof, which may be used to alleviate the known side effects of MDMA while retaining its efficacy.

Building on preclinical animal studies completed at the University of Arkansas School for Medical Sciences, the Issuer has developed evidence of the improved safety pharmacology of its ALA series of MDMA analogs (the “ALA Series”), which includes evidence of diminishing hyperthermia reduced stimulant-like effects, and cardiotoxicity, while retaining its therapeutic effects. The ALA Series is composed of three distinct NCEs. The

Issuer’s PCT application also includes the composition of three novel compositions of 1,3-benzodioxolyl-N- methylbutanamine, a lesser-known analog of MDMA, which also presents an improved toxicology profile based on animal models.

Master Services Agreement with Filament Health Corp.

On May 18, 2022, the Issuer entered into a master services agreement with Filament Health Corp. (“Filament”) and Filament’s wholly owned subsidiary, Psilo Scientific Ltd. (“Psilo Scientific”), for the manufacturing of MDMA capsules for the Issuer and other related services (“Filament Agreement”).

On April 11, 2023, the Issuer received 2,200 MDMA capsules from Filament, encapsulated at Psilo Scientific’s GMP-compliant Health Canada licensed facility, for a total consideration of C$152,000. The Issuer’s MDMA capsules are destined for distribution to clinical trial customers and authorized patients in Canada and globally.

Purchase Order from Clinical Psychedelic Lab at Monash University

On April 19, 2023, the Issuer became the MDMA manufacturing partner of the Clinical Psychedelic Lab at Monash University (“Clinical Psychedelic Lab”), for their upcoming phase 2 clinical trial. The Issuer received an initial purchase order from Clinical Psychedelic Lab for 185 capsules of the Issuer’s GMP MDMA that contain a total of 8 grams of GMP MDMA for an aggregate consideration of US$16,650, excluding transportation costs.

Purchase Order from Incannex Healthcare Ltd.

On April 24, 2023, the Issuer received a purchase order for 300 capsules of GMP MDMA that contain a total of 12 grams of GMP MDMA, and 100 capsules of psilocybin that contain a total of 2.5 grams of psilocybin, from Incannex Healthcare Ltd. (“Incannex”), a NASDAQ-listed psychedelic research company and clinic operator based in Australia, for an aggregate consideration of US$55,250, excluding transportation costs.

Incannex is a clinical stage pharmaceutical development company that is developing medicinal cannabis pharmaceutical products and psychedelic medicine therapies for the treatment of obstructive sleep apnea, traumatic brain injury and concussion, lung inflammation, rheumatoid arthritis, inflammatory bowel disease, anxiety disorders, addiction disorders, and pain, among other indications.

Joint Venture with Vitura Health Limited

On May 1, 2023, the Issuer entered into a joint venture with an Australian-based company, Vitura Health Limited (“Vitura”) (the “Joint Venture Agreement”), pursuant to which the Issuer and Vitura incorporated a joint venture entity, Cortexa Pty Ltd. (“Cortexa”) (the “Vitura Joint Venture”). Cortexa is an Australian company, jointly owned by the Issuer and Vitura and with equal board representation, which will be used to provide MDMA

and psilocybin products for clinical use to TGA’s authorized prescribers and for use in clinical trials undertaken by academic and commercial researchers.

Under the Joint Venture Agreement, the benefit of any sale orders for the MDMA and psilocybin products received by the Issuer from February 26, 2023, have been transferred to Cortexa. As the Issuer already completed manufacturing a batch of MDMA and psilocybin, these products are available to Cortexa for import into Australia for supply to medical practitioners under the TGA’s authorized prescriber scheme, once the changes come into effect on July 1, 2023.

As part of the Vitura Joint Venture, the Issuer anticipates that Cortexa will receive a license for the Issuer’s manufacturing technology and intellectual property, allowing for the efficient manufacturing of MDMA and psilocybin in Australia under GMP conditions (the “Intellectual Property”). Pursuant to the terms of the license for the Issuer’s Intellectual Property, Cortexa will pay the Issuer a licensing fee of AUD$250,000 per annum for three years from the date of the Joint Venture Agreement. Pursuant to the terms of the Joint Venture Agreement, Cortexa will also pay the Issuer a royalty equal to 5% of the net profit generated by Cortexa.

The Vitura Joint Venture is conditional on, among other things:

- Vitura being satisfied that the Issuer has, either directly or under license, all necessary intellectual property to allow Cortexa to utilize, sub-license and commercialize such intellectual property for the manufacture, marketing, sale and distribution of GMP MDMA and psilocybin products in Australia; and

- The parties receiving any requisite regulatory approvals and permits from the relevant governmental agencies and third parties.

Pursuant to the terms of the Joint Venture Agreement, a break free of AUD$500,000 will be payable by the Issuer or Vitura, whichever is the breaching party, in the event of certain incurable breaches of the Joint Venture Agreement, resulting in the termination of the Vitura Joint Venture.

In connection with the Vitura Joint Venture, Vitura has agreed to advance a loan to Cortexa of up to AUD$2,200,000 at an interest rate equal to the official cash rate plus 5% per annum, should the loan be required.

Special Access Program Authorization for MDMA

On May 16, 2023, the Issuer and its distribution partner, C-Crest Laboratories Inc., operating as “Shaman Pharma” (“Shaman”) received an authorization to supply its MDMA capsules to a Canadian physician for treatment of a patient under Health Canada’s special access program (the “SAP”). The Issuer and Shaman will not be charging the patient or the physician for the supplied MDMA, as it will be delivered on a compassionate-use basis.

Research Grant by Ontario Centre for Innovation

On June 9, 2023, the Issuer, together with the University of Windsor, has been granted a research grant in the total amount of $25,000 by the Ontario Centre for Innovation (the “Research Grant”). The Research Grant was granted to the Issuer for in silico modeling of MDMA analogues, for the purposes of drug discovery.

U.S. Food and Drug Administration Approval of MDMA for Clinical Trial Use in the United States

On June 9, 2023, the Issuer and the University of California (“UCLA”) received an approval from the U.S. Food and Drug Administration for the use of the Issuer’s 40 mg capsules of investigational medical product MDMA in a clinical trial in the United States. The trial is for the research of MDMA in treatment of individuals suffering from schizophrenia. See the Issuer’s news release on October 4 th, 2022, available under the Issuer’s profile on

SEDAR at www.sedar.com, on the Issuer’s partnership with UCLA.

Material Facts

There are no material facts about the securities being distributed that have not been disclosed in this Offering Document or in any other document filed by the Issuer in the 12 months preceding the date of this Offering Document.

What are the business objectives that we expect to accomplish using the available funds?

The business objectives that the Issuer expects to accomplish using the net proceeds of the Offering, together with existing cash and cash equivalents, are: (i) an increase in the Issuer’s inventory of MDMA and psilocybin for the future sales in Australia and outside Australia, and (ii) phase 2 clinical trial of the Issuer’s provisionally patented molecules, ALA series of molecules (the “Phase 2 Clinical Trial”). The Issuer anticipates spending approximately C$2,000,000 to increase its inventory of MDMA and psilocybin, which the Issuer expects to be sufficient in expanding its market presence and fulfilment of purchases orders in Australia and outside of Australia over the next two years. In connection with the Phase 2 Clinical Trial, the Issuer anticipates spending approximately C$2,000,000 over the next two years to (i) conduct clinical trial for the use of one of the patented ALA series of molecules as a treatment of social anxiety symptoms in autistic young adult population, and (ii) file for corresponding patents and/or regulatory approvals in one or more countries, or to perform subsequent research. The Issuer anticipates the Phase 2 Clinical Trial to begin at the end of the 2023 calendar year, and complete in the 2025 calendar year.

PART 3 USE OF AVAILABLE FUNDS

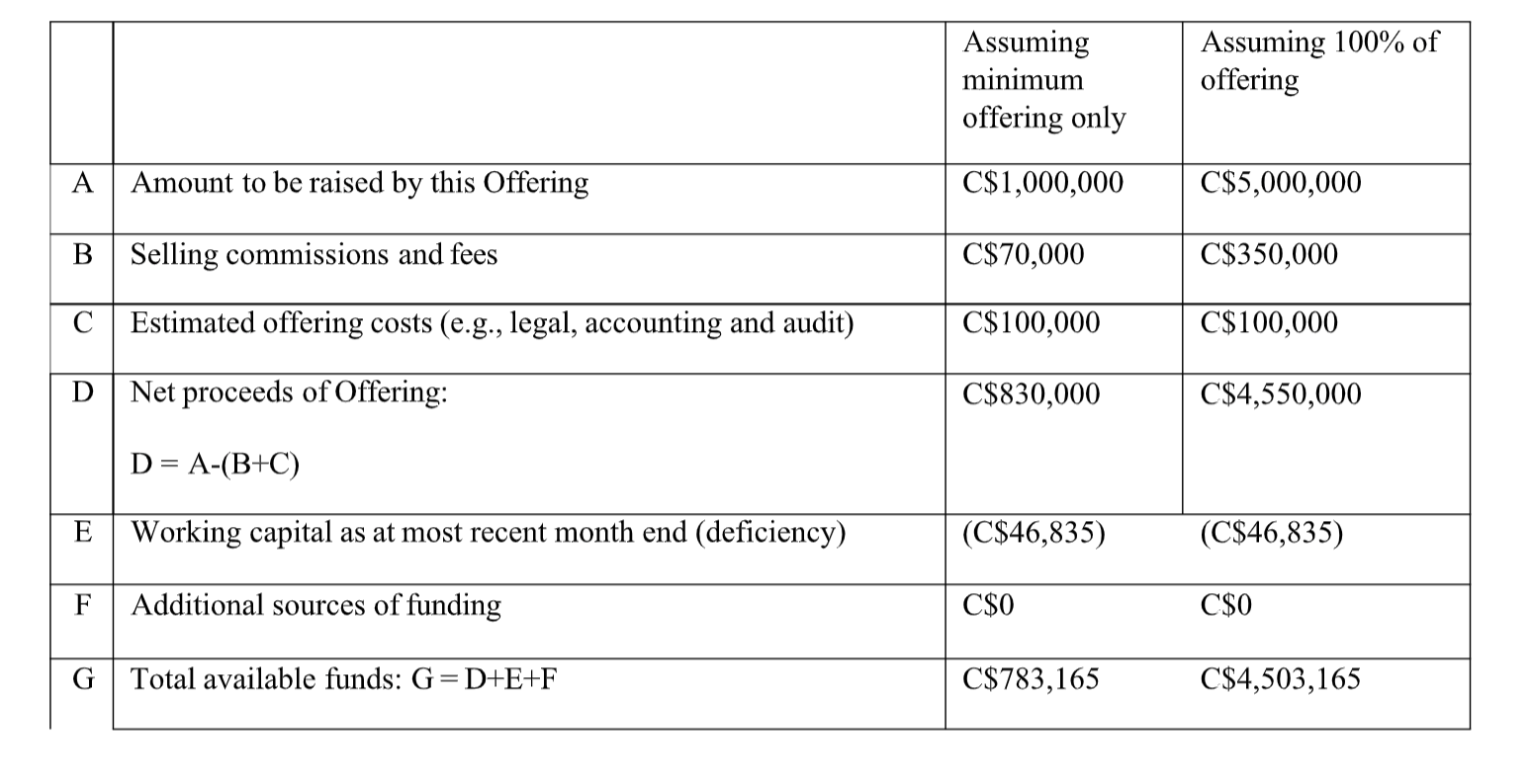

What will our available funds be upon the closing of the offering?

As at August 31, 2022, the Issuer had a working capital of C$661,691, compared to its current working capital deficiency of C$46,835. The Issuer’s working capital declined due to (i) an increase in customer deposits for the Issuer’s products that are not shipped yet, and (ii) the Issuer’s investment into intellectual property.

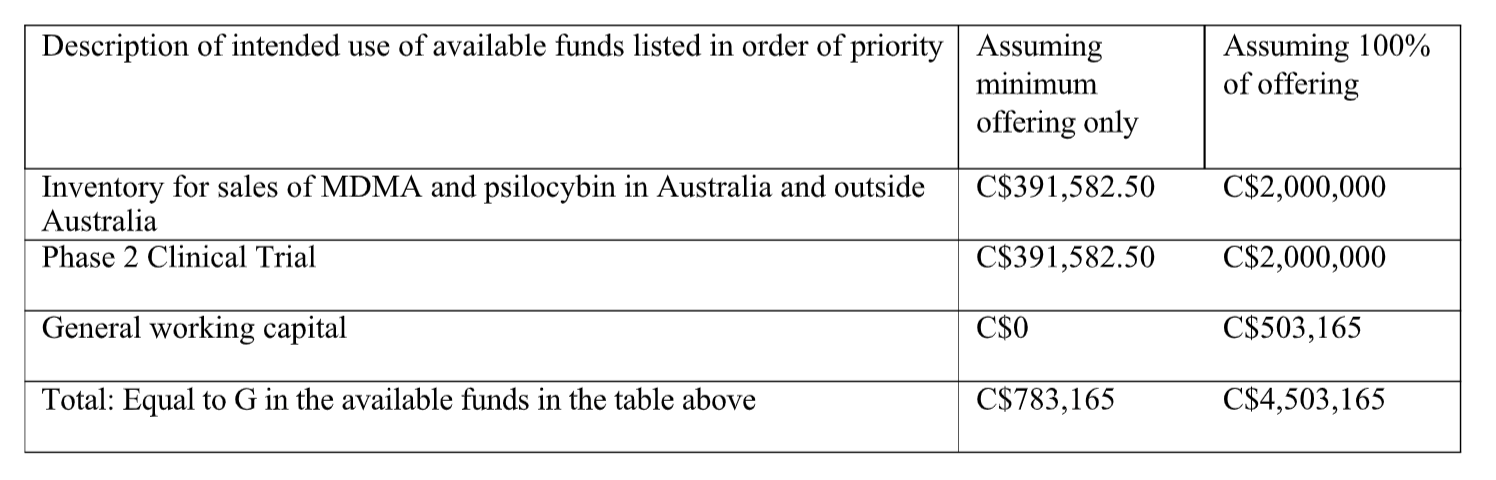

How will we use the available funds?

As disclosed under the “What are business objectives that we expect to accomplish using the available funds?” heading, the Issuer will use the available funds to increase its inventory of MDMA and psilocybin for the future sales in Australia and outside Australia and to conduct the Phase 2 Clinical Trial. More particularly, assuming 100% of the Offering, the Issuer will allocate: (i) C$2,000,000 for an increase in MDMA and psilocybin

inventory for the Australian market, (ii) C$2,000,000 to conduct the Phase 2 Clinical Trial for the company’s patented molecules over the next two years, and (iii) C$503,165 for general working capital.

If the Issuer raises less than C$5,000,000 from the Offering, the funds will be allocated on a pro-rated basis, where 50% of the funds will be allocated towards the increase of MDMA and psilocybin inventory for the future sales in Australia and outside Australia and 50% of the funds will be allocated to conduct the Phase 2 Clinical Trial.

The Issuer expects that C$2,000,000 will be sufficient to complete the Phase 2 Clinical Trial, which will be utilized to commercialize the developed intellectual property through the out-licensing to an established pharmaceutical company. The Issuer anticipates spending approximately C$1,500,000 on the venue for the Phase 2 Clinical Trial, principal investigator and trial site at the University of Sydney, and C$500,000 in administrative costs pertaining to the Phase 2 Clinical Trial, including the hiring and/or contracting personnel to assist with running the trial. More particularly, the Phase 2 Clinical Trial is a phase 2a/2b trial, which will be completed in two tranches. The first tranche will evaluate the proper dosage of the ALA molecules utilized in the trial and is expected to cost approximately $600,000. The second phase will evaluate the dose-dependent efficacy of the ALA molecules in treating symptoms of social anxiety in patients diagnosed with social anxiety disorder, anticipated to cost approximately $900,000. The Phase 2 Clinical Trial will be performed by the Issuer, with potential assistance by a locally hired clinical trial manager, either sub-contracted or hired directly. The research will be conducted through a combination of in-house and outsourced consultants. The clinical trials will be performed by subcontractors. The Phase 2 Clinical Trial will be subject to a 43% rebate by the Australian government.

The Phase 2 Clinical Trial for the use of ALA-001 or ALA-002 will begin in the 2023 calendar year, with an expected completion in the 2025 calendar year.

The Issuer’s most recently filed audited financial statements included a going concern note. The Issuer expects that this Offering will be sufficient to cover the Issuer’s operating costs for the next 12 months while giving the Issuer the ability to build and scale its market presence in the Australian market. However, the Offering is not expected to affect the decision of the Issuer to include a going concern note in the next audited annual financial

statements or interim financial report.

How have we used the other funds we have raised in the past 12 months?

The Issuer did not raise any other funds in the past 12 months.

PART 4 FEES AND COMMISSIONS

Who are the dealers or finders that we have engaged in connection with this offering, if any, and what are their fees?

The Issuer has not engaged any dealers or agents in connection with the Offering. The Issuer may compensate certain finders with a cash commission of up to 7% of the aggregate gross proceeds raised from the Offering and issue finder’s warrants equivalent to 7% of the total Units subscribed under the Offering.

PART 5 PURCHASERS’ RIGHTS

Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this offering document, you have a right:

a) to rescind your purchase of these securities with the Issuer, or

b) to damages against the Issuer and may, in certain jurisdictions, have a statutory right to damages from other persons.

These rights are available to you whether or not you relied on the misrepresentation. However, there are various circumstances that limit your rights. In particular, your rights might be limited if you knew of the misrepresentation when you purchased the securities.

If you intend to rely on the rights described in paragraph (a) or (b) above, you must do so within strict time limitations.

You should refer to any applicable provisions of the securities legislation of your province or territory for the particulars of these rights or consult with a legal adviser.

PART 6 ADDITIONAL INFORMATION

Where can you find more information about us?

You can access the Issuer's continuous disclosure filings on SEDAR under the Issuer’s profile at www.sedar.com. You can find out more information about the Issuer at www.pharmala.ca.

PART 7 CERTIFICATE OF THE ISSUER

This offering document, together with any document filed under Canadian securities legislation on or after June 12, 2022, contains disclosure of all material facts about the securities being distributed and does not contain a misrepresentation.

About PharmAla

PharmAla Biotech Holdings Inc. (CSE: MDMA) is a biotechnology company focused on the research, development, and manufacturing of MDXX class molecules, including MDMA. PharmAla was founded with a dual focus: alleviating the global backlog of generic, clinical-grade MDMA to enable clinical trials, and to develop novel drugs in the same class. PharmAla is a “regulatory first” organization, formed under the principle that true success in the psychedelics industry will only be achieved through excellent relationships with regulators. Our team of dedicated professionals includes regulatory experts, scientists, and biomanufacturing professionals. PharmAla has built what it believes to be North America’s first cGMP MDMA value chain, encompassing GMP manufacturing of Active Pharmaceutical Ingredient (API), and drug product formulation. PharmAla’s research and development unit has also begun preclinical research into two patented Novel Chemical Entities (NCEs) based on MDXX class molecules, with proof-of-concept research currently ongoing at the University of Arkansas Medical School.

Media Inquiries

Nicholas Kadysh, CEO

press@pharmala.ca